5 Simple Statements About Certified Home Loans Raleigh North Carolina Explained

A mortgage loan broker performs a vital role in serving to folks and family members find the best dwelling loan to match their money requires. Acting as an intermediary among borrowers and lenders, a home finance loan broker is effective to understand a consumer’s economic predicament, homeownership aims, and Tastes. With usage of a broad community of lenders, they might Look at various loan goods, interest rates, and terms to identify the very best choices accessible. Their experience can simplify what is often an advanced and too much to handle system, rendering it less complicated for consumers to safe favorable home loan terms without having to negotiate instantly with many financial institutions or lending institutions.

Among the important benefits of working with a mortgage broker is definitely the personalised services they offer. Brokers make the effort to guidebook clients by Every single step with the mortgage loan software approach, making sure all paperwork is accomplished correctly and submitted immediately. In addition they support explain the different sorts of home loans, including preset-charge, adjustable-level, or federal government-backed financial loans, so customers may make well-knowledgeable conclusions. By handling the investigation and interaction with lenders, mortgage loan brokers help save clients important time and worry, assisting them transfer nearer to homeownership with bigger self-assurance.

A different vital benefit of using a house loan broker is their power to advocate for the client’s greatest passions. Contrary to personal loan officers who represent a specific lender, home loan brokers perform independently, meaning their concentration continues to be on acquiring the most beneficial loan options for their clients. They are able to frequently secure much better prices or loan circumstances that might not be easily accessible to most of the people. In aggressive markets, getting a skilled broker can make An important change in finding pre-permitted speedily and standing out amid other consumers.

Choosing the right property finance loan broker is vital into a smooth and successful homebuying working experience. It is crucial to pick a broker who is certified, knowledgeable, and highly encouraged by previous clients. A fantastic broker will supply clear interaction, transparency concerning service fees, plus a commitment to performing within the customer’s very best desire. With the correct Experienced by your aspect, navigating the property Mortgage finance loan method becomes much fewer challenging, earning the dream of possessing a house an achievable and gratifying fact.

Mason Gamble Then & Now!

Mason Gamble Then & Now! Michael Oliver Then & Now!

Michael Oliver Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Lacey Chabert Then & Now!

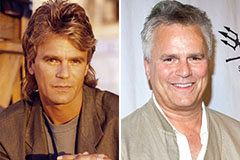

Lacey Chabert Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!